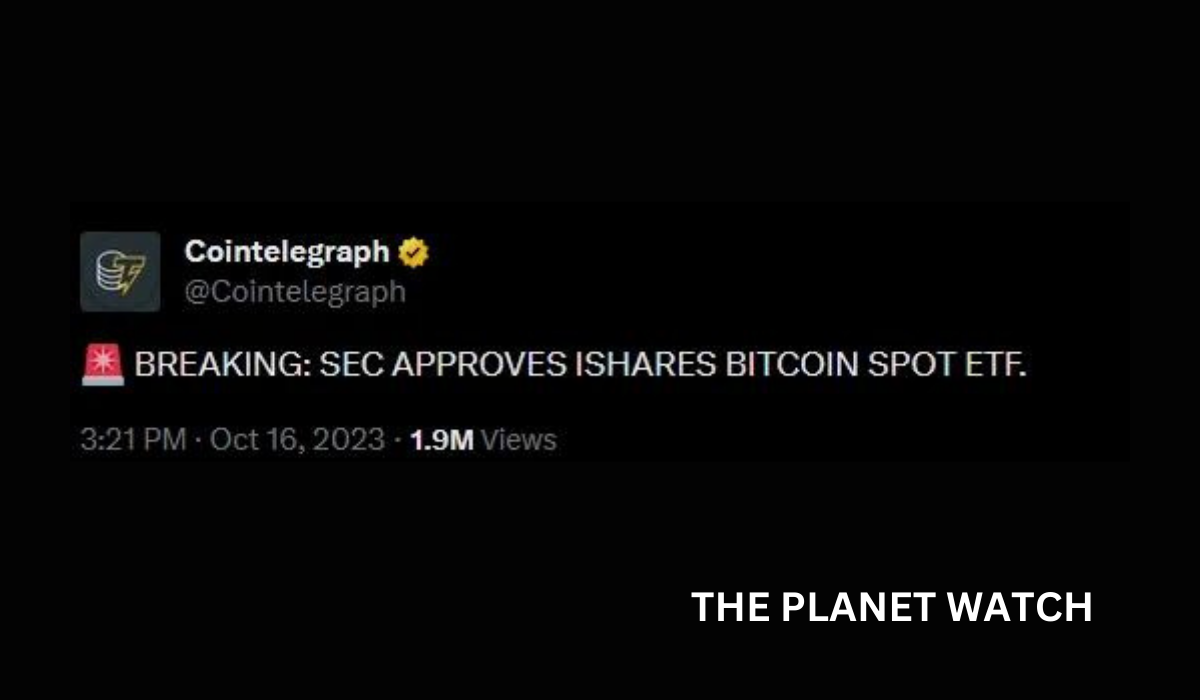

fake ETF news just wiped over $150 Million of positions in a few minutes ;

“They once again prove that they should never be taken seriously or even given attention when dealing with such a sensitive topic without proper confirmation.

BlackRock has confirmed that the news was fake (source: Bloomberg).”

Right after the news arrived, Boomberg ETF analysts already had their doubt. Massive red flag when people like those that are on a high professional level ask an entity like Cointelegraph for sources… https://twitter.com/EricBalchunas

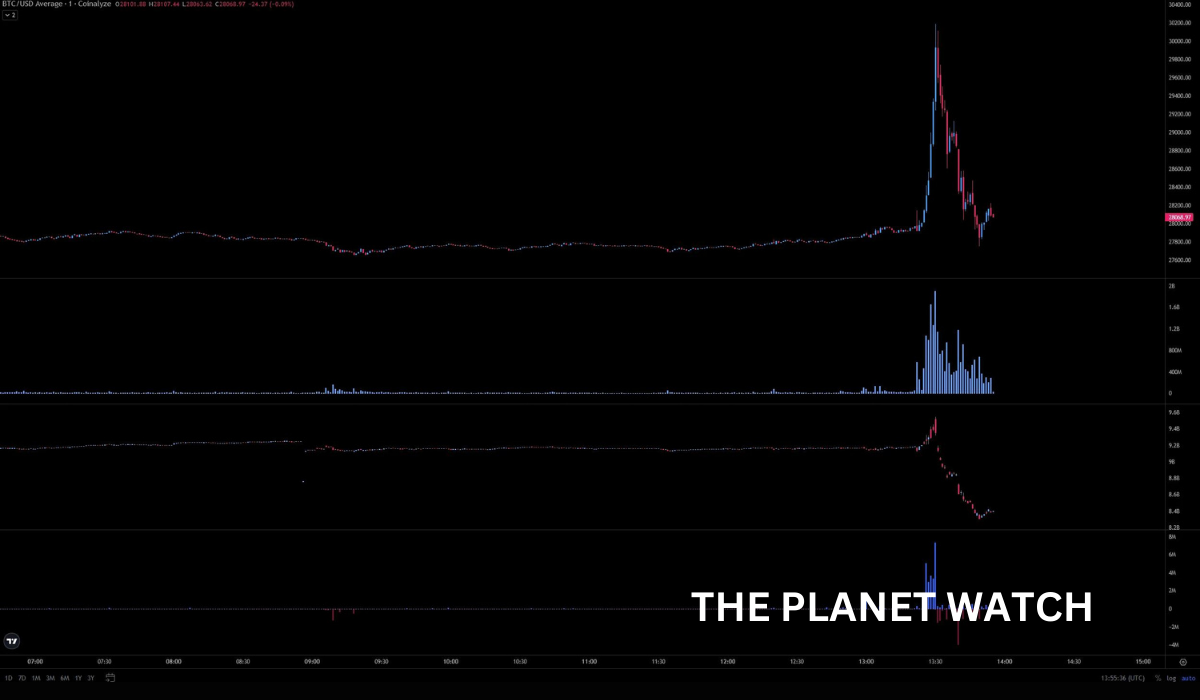

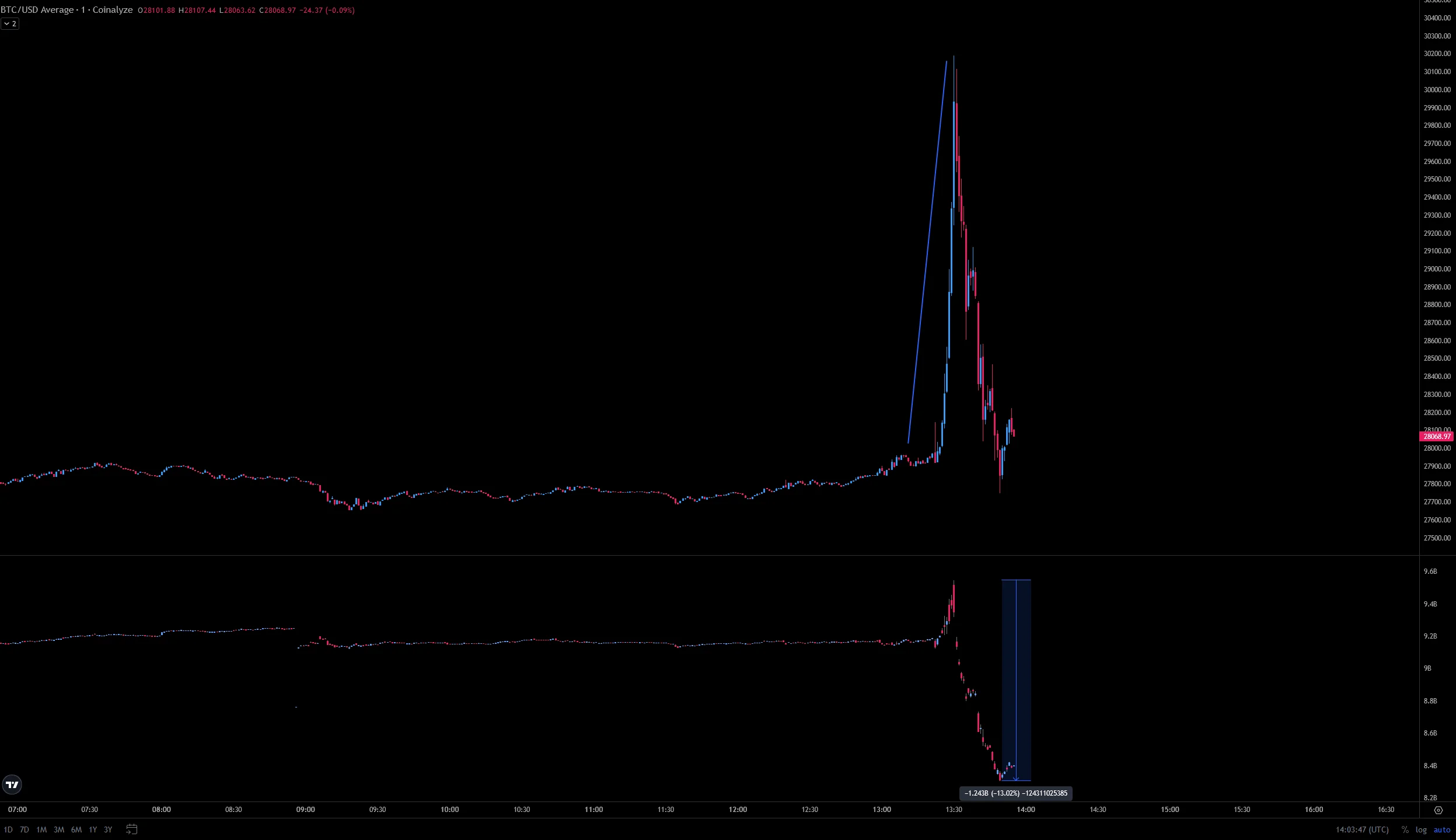

Impact of fake ETF news

The chart above shows the minute chart price action on the fake ETF news. Volume spiked heavily, open interest as well same as liquidations.

Bears & Bulls got liquidated after fake ETF news

on the way up over 110 Million shorts got rekt. All ranging from 28k -> 30k

Right after, all positions on the way up also got rekt due overleveraged gamblers betting on a further rise. A quick -30 Million were also completely rekt all the way back down.

This metric is even more astonishing because it reveals not only the total number of positions opened and closed during that time, but also highlights a significant number of long positions that took profits as the market dropped, while others entered at a risky time.

In my opinion, relying on sources that confirm ETF approval from a single entity is not advisable. Typically, if one ETF is approved, others tend to follow suit. This approach is primarily to ensure fairness and to prevent the SEC from facing accusations of favoritism, given that they have consistently either declined or delayed them for broad, non-specific reasons.

While this development may be disheartening for many, it’s important to remember that it doesn’t alter the fact that the likelihood of an ETF approval remains very high. Analysts currently estimate a probability of over 90%, with some even suggesting it could happen within this year.

FAQ’S About Fake ETF News

- What caused the sudden spike in Bitcoin prices?

- The spike in Bitcoin prices occurred due to false reports circulating online about the SEC approving BlackRock’s iShares Bitcoin ETF.

- Was the news of the ETF approval confirmed by BlackRock?

- No, a spokesperson from BlackRock stated that the iShares Bitcoin ETP application is still under review by the SEC.

- Where did the fake ETF news originate?

- As of the latest information available, the exact source of the false report remains unclear.

- Which sources were among the first to share the incorrect information?

- Crypto outlet Cointelegraph was one of the initial sources to share the incorrect information. They have issued an apology and promised to conduct an investigation.

- Who first encountered the news on the Bloomberg Terminal?

- Senior ETF Analyst for Bloomberg, Eric Balchunas, appears to have first come across the news from a Bezinga Newswire via Reuters on the Bloomberg Terminal.

- Has false crypto news influenced the market in the past?

- Yes, false crypto news has previously led to market movements. For instance, fake press releases about major retail chains accepting cryptocurrencies have caused temporary spikes in cryptocurrency prices.

- What impact did the debunking of the Bitcoin fake ETF news have on prices?

- After the news about the Bitcoin ETF was debunked, prices dropped back down to levels they were at prior to the false reports.

- Why is the approval of a Bitcoin ETF significant for the crypto industry?

- Many cryptocurrency advocates believe that an approved ETF would help legitimize Bitcoin and attract investors back to the market, which has faced challenges in recent times.

- What is an ETF (Exchange-Traded Fund)?

- An ETF is a bundle of investments that are traded on the stock market. In the case of a Bitcoin ETF, it would allow retail investors and others to invest in Bitcoin via the stock exchange without owning the actual digital asset.

- Has the SEC approved any Bitcoin ETF applications so far?

- No, as of now, the SEC has not approved any Bitcoin ETF applications, including BlackRock’s. BlackRock has confirmed that their application is still under review.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.